Patent Strategy Adopted by

Financial Institutions of Taiwan Analyzed

published on 23 May 2019

The Taiwan Intellectual Property Office (“TIPO”) has completed a survey as its collects patents from its database in relation to financial technology (“FinTech”) filed by Taiwanese financial institutions from 2006 to March of 2018. With more than 700 patents in the sample pool, TIPO has produced the analytical statistics and presented the trends of innovative developments by financial institutions of Taiwan.

Invention Patents v. Utility Models

Utility model accounts for the majority of FinTech patents of Taiwan. Among 726 applications, only 399 cases were filed as utility models whereas 105 cases as invention patents. In addition, 222 cases had been, concurrently, filed as both utility model and invention patent. Obviously, applicants of financial institution have the preference using utility model that applies to system, structure, or shape of articles to protect their subject matters. Even though utility model can be advantageous in its short pendency, apparently the lack of search or substantive examination does not secure a granted utility model to a presumption of validity.

If the core business of financial institutions is integrated with the utilization of advanced technology, it is very likely that a computer method will be involved. It would, therefore, imply an invention patent claiming a process or method can be more beneficial in a way to provide more comprehensive protection over FinTech.

Filings in Different Business Sectors

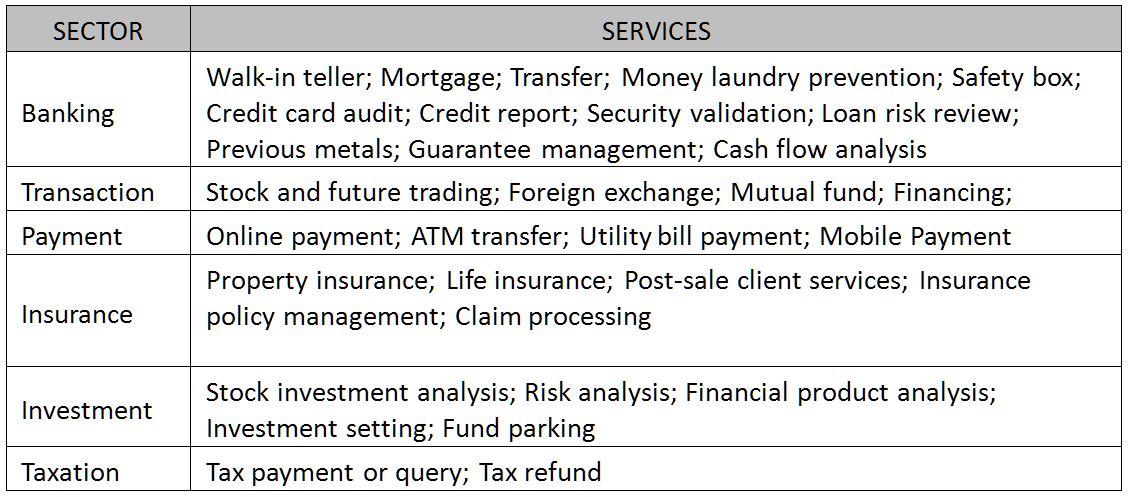

Patent applications for technologies used in “banking” were way more than other sectors, amounting to 38% of the total filings in this survey. Other major sectors where applicants were engaged in are transaction (17%), payment (15%), insurance (12%), investment (9%), and taxation (2%) respectively. Services of subject matters involved by applicants are found as follows.

Other applications not dedicated solely for FinTech account for 7% of the total filings. They include but are not limited to the optimization process for internal system of financial institutions, such as database management, file encryption, human resource management, and so on. Although they might not correlate with FinTech in direct terms, such software or hardware, innovation can be essentially critical to the efficiency, convenience, and safety of various services provided by the financial institutions. .

Filings in Different Technology Sectors

Technical fields of patents, according to the survey, include: mobile platform, big data, artificial intelligence (“AI”), cloud system, blockchain, Internet of things, user interface, teller system automation, general information, and others. Unfortunately, the category of “general information” accounts for the majority of the cases, totaling about 37% of all, and they do not involve novel innovation, but merely data collection and sorting in a client-server model without resorting to any concept of big data, AI, cloud system, or the like. For example, the application of an invention patent directs to a system and it simply transforms the review process and audits requests for mortgage loan using a digital system or a computerized platform. However, such invention does not help Taiwan much to renovate itself as a FinTech powerhouse.

Short Conclusion

Financial technology has been in the development since 2012, but applications of related invention on FinTech in Taiwan have not increased much afterward to 2016. It seems that local financial institutions have not kept abreast with international FinTech development concurrently.

In the survey, it is found that most of the subject matters were filed for utility models rather than invention patents. However, an invention patent which permits both apparatus and process can be a more beneficial option for financial institutions if they are to secure IP protection in a broader scope.

On the other hand, financial institutions of Taiwan should aim at the cutting-edge technologies as its innovative developments. Although there were filings in AI, big data, blockchain and so on, it is found that about 40% of the filings remain at mediocre level of technological utilization. As viewed, financial institutions of Taiwan should attempt to seek to integrate novel state-of-art into their services for only brand new transformation and service upgrade can create advantage to deal with the next-generation competition in a global scale.

for any questions relating to this topic, please contact us at cjchen@tsailee.com.tw |