The Current Trend of FinTech

Related Patents in Taiwan

FinTech, short for “financial technology,” is often understood as integration of IT in financial services e.g. banking, insurance, investment, capital raising, etc. FinTech has become a popular topic lately because it opens up the traditional competition environment in finance, and integrates technology and the Internet into the field of digital finance. It is said that the innovation in finance may prompt Taiwan’s industry to transform to the next age, therefore, FinTech has attracted the government’s interests and attention.

The scope of FinTech applications includes various innovations in big data, the internet of things (IOT), mobile platforms, security mechanisms, and cloud systems. Many fintech inventions have been launched and their creators are seeking effective IP protection. Patent for computer software related inventions is an important mechanism to meet such a purpose. In response to this prosperous topic, the Taiwan IP Office (TIPO) held a seminar in July inviting discussion on the current statistics of patent filing, patentability of invention, and other prospectives in relation to FinTech.

Statistics

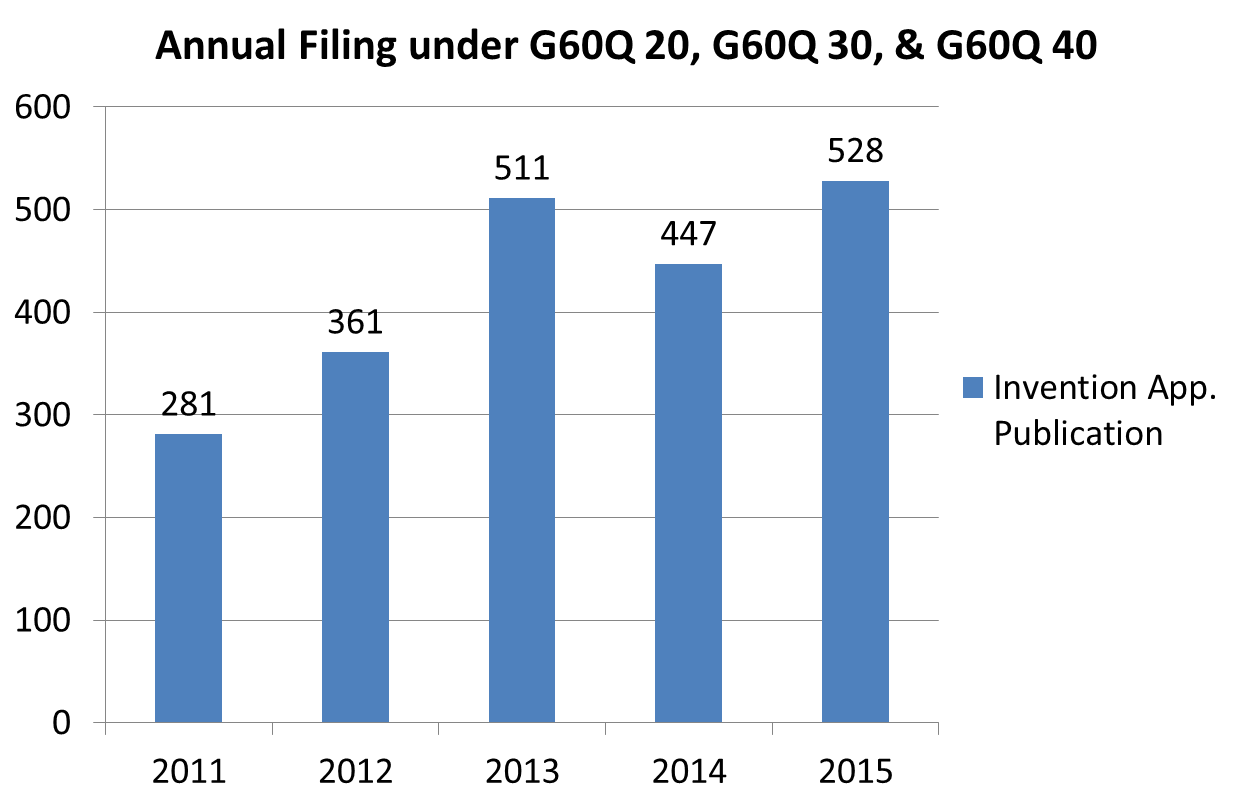

Fintech related patent filing in Taiwan is experiencing steady growth. By reviewing the statistical figures during the last five years, the count of patent applications filed under class G06Q of the International Patent Classification, namely computing, calculating, and counting related inventions is 5,244, in which 4,216 cases (approx. 80%) are filed by domestic applicants. Particularly, the annual filing count under G06Q 20 (payment), G06Q30 (commerce), and G06Q 40 (finance and insurance) has increased to more than 400 after 2013, as shown in Fig, 1.

Ø Fig. 1 (open statistics from TIPO)

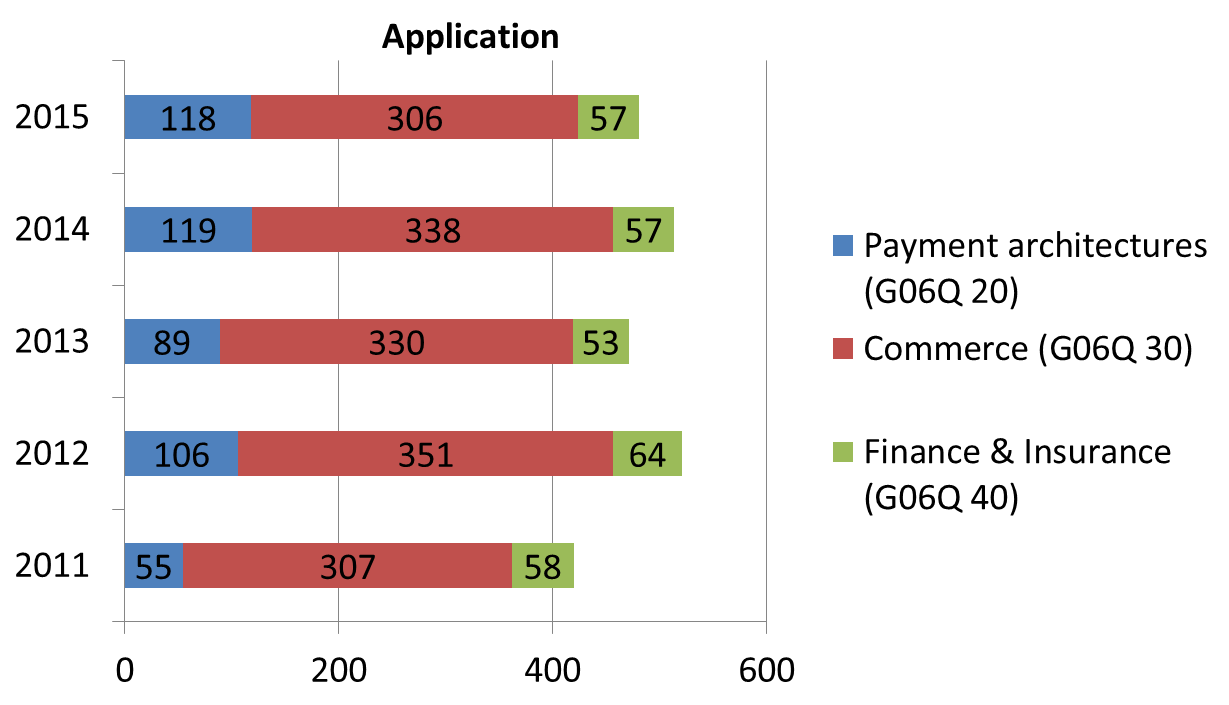

In more detail, the profile of application and grant in each classification during 2011 to 2015 is shown in Figs. 2 and 3. For classes of payment and commerce, more than 1/3 of applications have been granted to patents. Granting rate for finance & insurance is even higher.

Ø Fig. 2 (open statistics from TIPO)

Ø Fig. 3 (open statistics from TIPO)

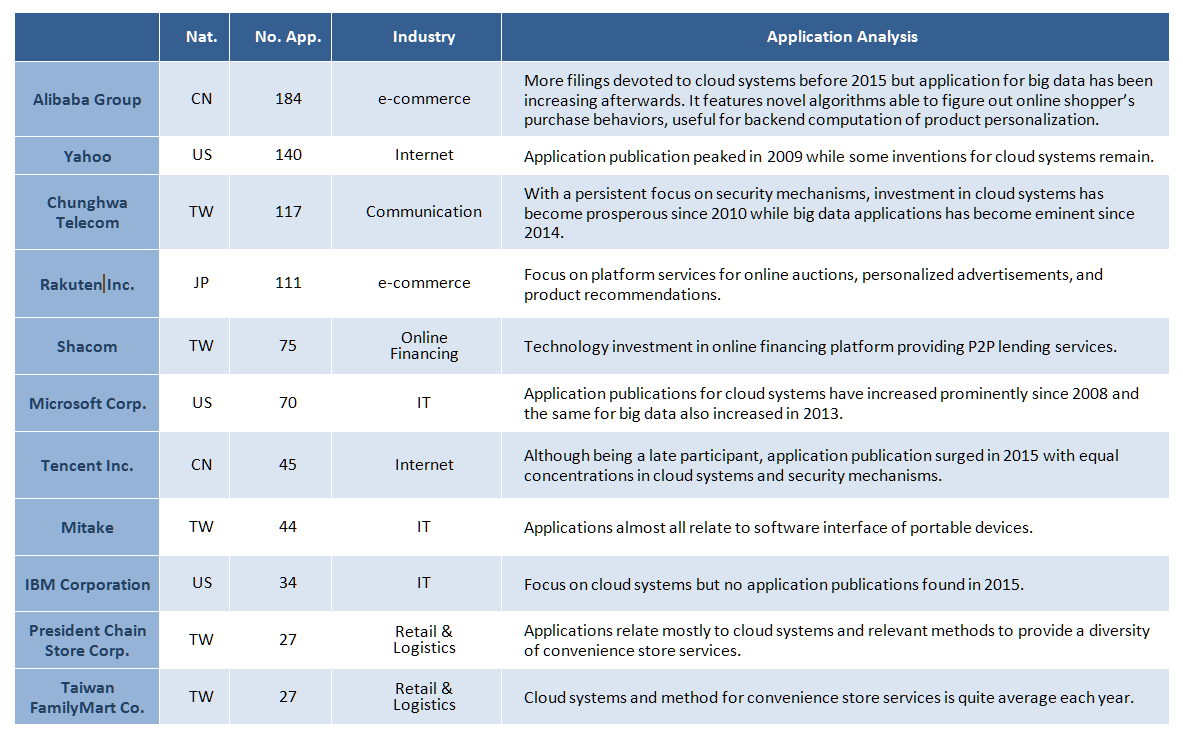

The representative top 11 filers for FinTech innovations during the past 10 years are shown in below table, according to the TIPO’s search database. Respectively each applicant has its own concentration of patent filing portfolio which somehow reflects its business development strategy. Among the top 11, domestic applicants account for five seats.

Patentability

Article 21 of the Patent Act defines an invention being “[t]he creation of technical ideas, utilizing the laws of nature.” Deriving from the statutory definition, an invention, including one leading to FinTech, has to have “technical character,” suggesting that the invented means for solving a given technical problem has to be a technical means in the engaged technical field. More specifically it is provided in the Guidelines for Patent Examination which specifies that the entirety of the means for solving a given technical problem must have technical characters when the technical effects that are beyond regular physical phenomena between the program and computer has arisen during the execution of said program. A mere presentation of financial information or simple utilization of computers is not a patentable subject matter because they only produce an effect that is the same as the original functionality of regular software or hardware. On the contrary, when a software or hardware is indispensable, unique, overcoming difficulties, or substitutes for human work, to solve technical problems by making improvements or by bringing about new functions, it will be eligible subject matter. For example, an eligible business method is indicated here, as reworded regardless of formality herein presented,1

A business method for buying variable credits comprising:

Inputting a datum of a card product to an electronic device;

Inputting a designated amount of transaction by a client to said electronic device;

Connecting said electronic device to a logistic server;

Confirming the card product and the designated amount of transaction by the logistic server; and

Printing a password for bought credits by a printed connected to said electronic device.

The subject matter described in the claim is patent eligible because the hardware employed herein is found unique and irreplaceable. That, for selling cards of game credits, suppliers need to make cards with fixed denominations which is a burden for both storing and clearing inventory has been successfully solved by the invention.

A FinTech invention further needs to have inventive step before being granted patentability. Notably an invention possesses an inventive step if an invention produces the same effect or function only by, application in different technical fields, equivalent replacement or by addition of publicly known technical features, systemization of people’s transactional or business activities by regular methods, or softwarization of the functions executed by hardware, except that either one of the aforementioned means produces unexpected results or solutions to the long-felt needs. However, the addition of a feature that does not contribute to technical character does not enhance inventive step. For instance, a claim indicates, as reworded regardless of formality herein presented,

An online transactional system comprising:

A web server, wherein a variety of products are displayed on web pages for browse by customers; and

A transactional server, wherein said transactional server receives customers’ online orders and, after obtaining payments, instructing a logistics server for scheduling shipment;

Wherein the online transactional system applies a full refund policy guaranteeing customers to refund or exchange products within seven days since purchase.

Unfortunately because the “full refund policy” is not contributing to technical character of the invention, this claim does not make over prior arts and therefore has no inventiveness. In summary, whether a software-related invention is a patentable subject matter depends on the existence of “technical character.” A repackaging of a business model by using simple computer skills is not eligible for patents. For determining an inventive step, whether a feature contributes to technical character, among others, serves as an auxiliary factor. An addition of a feature that does not help in enhancing technical character is futile.

Turning Negatives into Positives

As a rising topic, FinTech can be both an opportunity and a challenge for Taiwan’s finance and IT sectors. It is very obvious that each bank has formed its own strategy planning for patent protection schemes in FinTech innovations. Besides, most domestic banks are not yet fully familiar with that to which extent the patent system can do benefits to them. As for the IT sectors, legal restrictions, developing more IT applications in financial industry, reforming client’s orientation using technologies in personal banking, acquiring more funds investing in R&D, etc. can all be difficult barriers.

In a positive light, where there is a challenge, there comes an opportunity. Taiwan’s FinTech is not fully blown, banks and IT sectors may have more flexible options exploring for different tools or products. In addition, the government has fashioned policies and proposed new programs to support FinTech companies. Aides and resources in collaborative development are easier to obtain. To protect new inventive concepts in FinTech, patents are a necessary instrument. Since Taiwan seems to be rather liberal in the examination of patentability for computer software related inventions comparable to some foreign jurisdictions, a potential player in the FinTech market should not easily back out from such a good opportunity occupying a niche.

_________________________________________________

for any questions relating to this topic, please contact us at cjchen@tsailee.com.tw

|